As advertising and targeting have shifted towards greater personalization, the destination of such traffic—the website—has predominantly remained unchanged. Fibr AI aims to close this gap by employing AI agents to transform conventional webpages into individualized experiences catered to each visitor. This innovative approach has led Accel to reaffirm its commitment to the company.

Accel has spearheaded Fibr AI’s $5.7 million seed funding round, following a previous $1.8 million pre-seed investment in 2024. This latest funding round also saw the participation of WillowTree Ventures and MVP Ventures, along with several Fortune 100 companies stepping in as angel investors and advisors, which brings the startup’s total funding to $7.5 million.

For large organizations, the disparity between increasingly tailored advertising and generic website experiences has traditionally been addressed through a combination of personalization software, engineering teams, and marketing agencies—an approach that is inefficient, costly, and challenging to scale. While advertisements can be adjusted instantaneously for diverse audiences, modifying a website for visitors often necessitates weeks of coordination and restricts teams to conducting only a handful of experiments annually. Fibr AI contends that this labor-intensive operational model is no longer feasible. Instead, the startup employs autonomous AI agents to assess user intent, generate various content versions, and yield real-time optimizations for webpages.

Fibr AI replaces the traditional agency and engineering-driven model with an autonomous system that continuously operates, according to Ankur Goyal, co-founder and CEO, in a recent interview.

“We represent the software, while our agencies are composed of the workforce of agents we deploy,” Goyal explained to TechCrunch, emphasizing that this enables Fibr AI to conduct thousands of parallel experiments instead of a limited few each year.

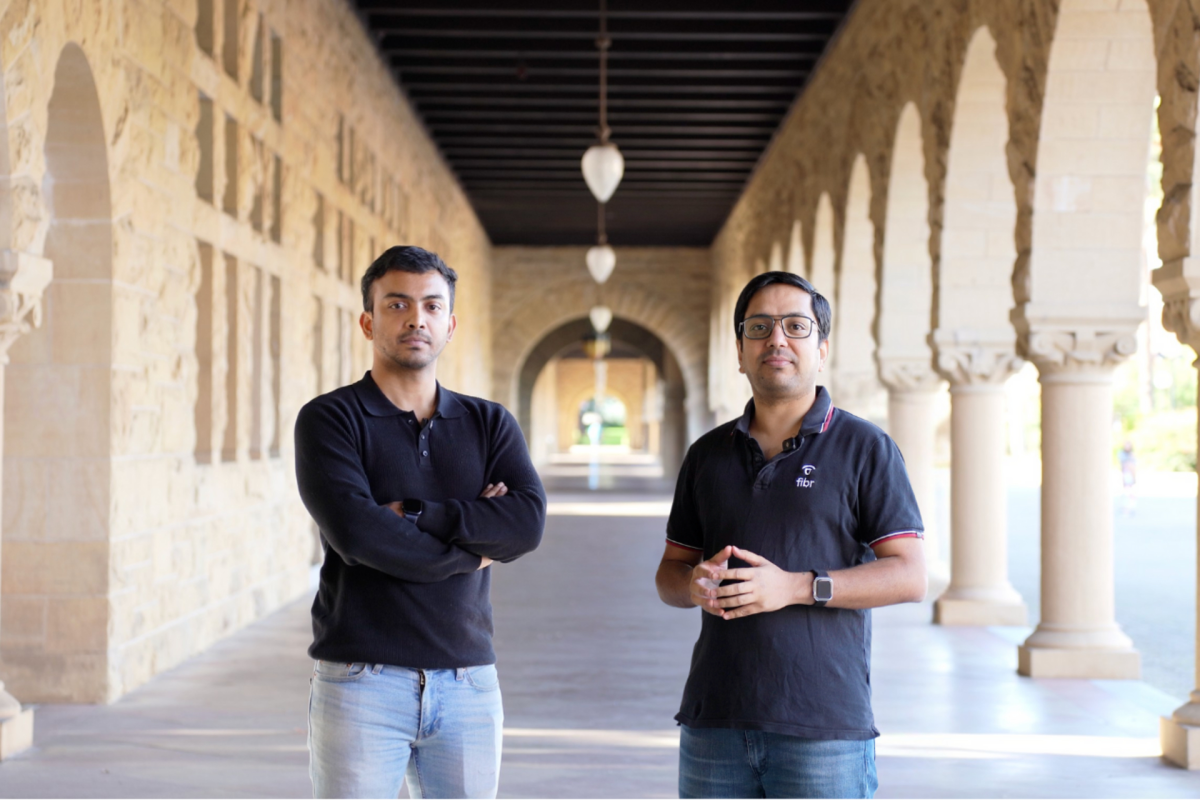

Initial adoption was slow. Founded in early 2023 by Goyal and Pritam Roy, Fibr AI had only one or two customers for most of its first two years, as enterprises took time to assess its novel approach. However, Goyal noted that interest began to surge last year among large U.S. firms, including banks and healthcare organizations, increasing the customer base to 12.

“We are essentially an infrastructure afterthought,” Goyal told TechCrunch. “Once established, little attention is given thereafter.” This has resulted in Fibr AI securing contracts ranging from three to five years with large enterprises, which typically prefer to standardize website infrastructure rather than continually revisiting it.

TechCrunch Event

Boston, MA

|

June 23, 2026

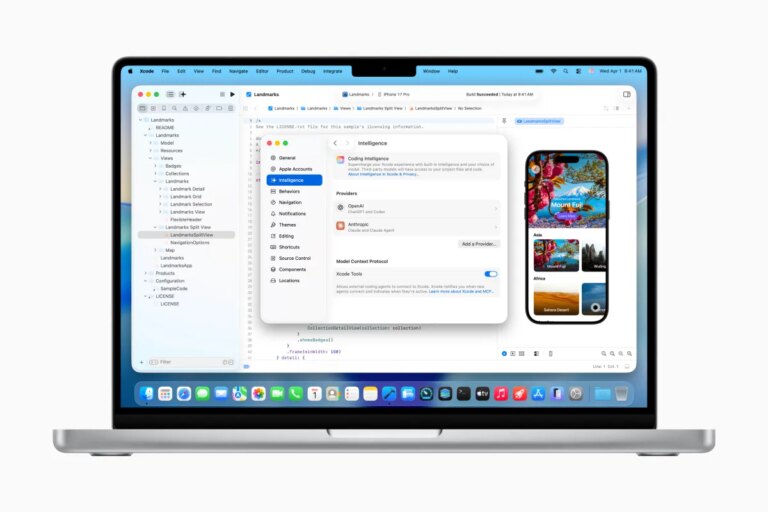

From a technical perspective, Fibr AI functions as a layer atop existing websites, interfacing with a company’s advertising, analytics, and customer data systems to understand visitor pathways and intentions. Its AI agents then curate and modify page content—such as text, images, and layouts—regarding each URL as a system that learns and optimizes continuously instead of a static page. Rather than relying on manually set rules or linear A/B tests, the platform executes numerous micro-experiments simultaneously and systematically updates experiences as traffic varies across channels.

This transformation holds significant cost implications for large businesses. Conventional website personalization often ties costs to software licenses, agency retainers, and engineering labor, rather than outcomes. Goyal indicated that enterprises are increasingly assessing Fibr AI’s platform based on metrics such as cost per experiment and conversion impact, rather than the number of tools or personnel involved.

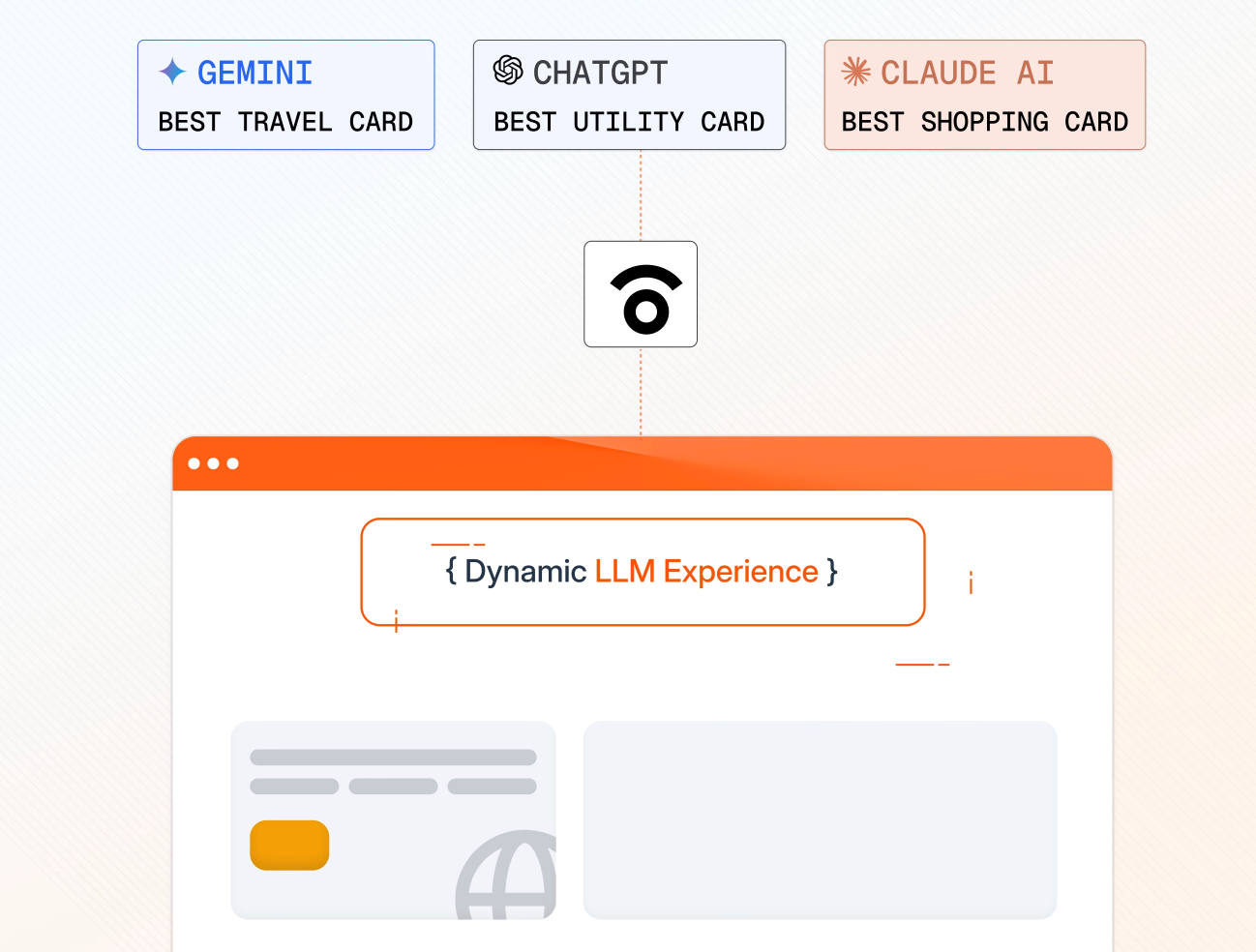

For Accel, this operational model—not merely the allure of AI—was pivotal for its renewed investment. “Advertising today is one-to-one, but when users land on a site, it transforms into one-to-many,” remarked Prayank Swaroop, a partner at Accel. “While you can generate numerous ads for distinct audiences, they all converge on the same page.” Fibr’s capacity to convert this scenario into one-to-one personalization, he noted, is remarkable as it alleviates the bottlenecks of agencies and engineering teams that typically hinder extensive experimentation.

Swaroop further stated that the early adoption by conservative sectors such as finance and healthcare validated the business model. “These industries are regulated and prudent,” he said. “When they express a need for the solution and are willing to invest, that solidifies our confidence in further commitment.”

Preparing for the Age of Autonomous Commerce

While most of Fibr AI’s current operations focus on personalizing experiences for human visitors, both Accel and Fibr AI recognize the potential in how AI agents are starting to facilitate online discovery. As consumers increasingly research, compare, and shortlist products using large language models and AI chatbots—including OpenAI’s ChatGPT—prior to visiting websites, Swaroop emphasized that the capacity for sites to adapt based on insights gathered by visitors or AI systems acting as proxies may become increasingly important in the future.

“That aspect remains in its infancy,” Swaroop acknowledged, “but we are keen to support companies that are addressing today’s demands while positioning themselves for future shifts.”

With the newly acquired funding, Fibr AI intends to prioritize the expansion of its sales and customer-facing teams in the United States while continuing to bolster its technical base in India. The San Francisco-based startup has an office in Bengaluru, where 17 of its approximately 23 staff members are located, with the remaining six based in the U.S.

Goyal indicated that the startup aims to achieve around $5 million in annual recurring revenue by the year’s end and hopes to secure partnerships with approximately 50 enterprise customers.

Fibr AI is venturing into a market traditionally dominated by established players such as Adobe and Optimizely, which provide experimentation and personalization tools for large enterprises. However, both Goyal and Swaroop contend that these platforms are hampered by their foundational structures and sales methodologies, typically relying on marketing agencies and engineering teams for configuration and operation. This model poses challenges for rapid action and scaling experimentation, even as customer acquisition and messaging continue to evolve dynamically.

“The incumbents have been slow to roll out products,” Swaroop stated, adding that even when new features are launched, they often lag years behind emerging demands.