Positron, a semiconductor startup, has successfully raised $230 million in Series B funding, as revealed exclusively by TechCrunch. The company intends to use these funds to expedite the deployment of its high-speed memory chips, which are vital for AI workloads, according to sources familiar with the situation.

This funding round has achieved a valuation of $1 billion for Positron, co-led by Arena Private Wealth, Jump Trading, and Unless, with strategic participation from the Qatar Investment Authority (QIA). The QIA, Qatar’s sovereign wealth fund, has been increasingly focused on enhancing AI infrastructure, as indicated by sources.

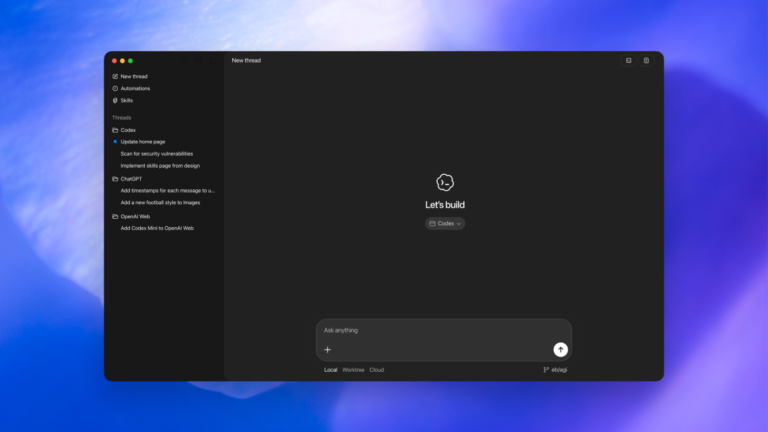

Positron, based in Reno, is securing its Series B funding at a time when hyperscalers and AI companies are working to lessen their dependency on Nvidia, a long-standing market leader. Notably, OpenAI, one of Nvidia’s key clients, has expressed dissatisfaction with some of the company’s recent AI chips and has been actively seeking alternatives since last year.

Moreover, Qatar, through the QIA, is advancing a broader initiative toward developing sovereign AI infrastructure, a priority highlighted during this week’s Web Summit Qatar in Doha. Several sources informed TechCrunch that the nation considers computational capacity essential for maintaining global economic competitiveness and aims to establish itself as a premier AI services hub in the Middle East, thereby generating interest in startups like Positron.

This strategy is already taking shape with significant commitments, including a $20 billion AI infrastructure joint venture with Brookfield Asset Management announced in December.

With this latest funding round, Positron has raised a total of over $300 million since its inception three years ago. Last year, the startup secured $75 million from a range of investors, including Valor Equity Partners, Atreides Management, DFJ Growth, Flume Ventures, and Resilience Reserve.

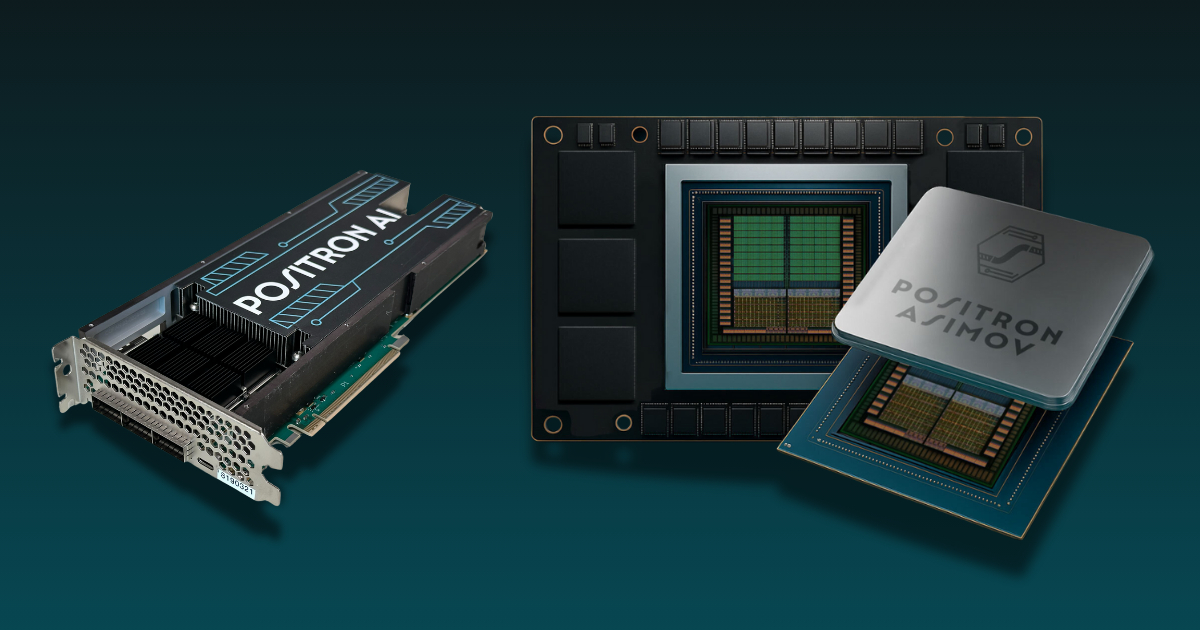

The company asserts that its first-generation chip, Atlas, produced in Arizona, delivers performance comparable to Nvidia’s H100 GPUs, while consuming less than a third of the power. Positron’s focus is on inference—the processing necessary for executing AI models in practical applications—rather than training large language models. This positions the company favorably as demand for inference hardware increases, as businesses shift their emphasis from model development to large-scale deployment.

TechCrunch Event

Boston, MA

|

June 23, 2026

With this infusion of capital, Positron plans to accelerate its timeline for launching the next-generation Asimov silicon chip, with production slated for early 2027.

Sources have indicated to TechCrunch that, in addition to its memory capabilities, Positron’s chips excel in high-frequency and video-processing tasks.

TechCrunch has reached out to Positron for further insights.

This article has been updated to reflect new information regarding Positron’s co-lead investors and valuation.

Correction: An earlier version of this article incorrectly stated the date of QIA’s partnership with Brookfield.